Luckily, FreshBooks can help you achieve a better work-life balance by automating time-consuming accounting tasks. Free up your day for more important work by automatically organizing expenses and following up with tenants. The all-new Accounting Software from FreshBooks empowers rental property owners like you to spend less time on bookkeeping and manage accounts without the stress. Rentmoji is a cloud-based rental property management solution geared toward small- and mid-sized businesses. For example, the software might send you an email or text with a one-time code so that your account is protected by two shields instead of only your password. Which real estate accounting software is suitable for your budget and will provide you with the features and flexibility your business needs?

- The software also includes advanced reporting tools to help landlords maximize their return on investment and simplify tax filing.

- Our suite of products works together to offer a streamlined accounting solution that keeps your finances in order, even when you’re busy tending to your properties.

- Additionally, any related expenses, such as property management fees, maintenance costs, or mortgage interest, need to be recorded in the respective expense accounts.

- The software’s time-tracking capabilities ensure users can accurately bill clients for hours worked, reducing the risk of undercharging.

- With its comprehensive tools, TenantCloud empowers landlords and property managers to grow their businesses while simplifying property management tasks.

Best for Rental Businesses

Multi-layer encryption, strong access controls, and robust security audits work to protect your account 24/7. Our team of experts, with over 185 years of combined experience in business and technology, tests and reviews software, ensuring our ratings and awards are unbiased and reliable. Note that the onboarding fee jumps up to $1,348 for when you onboard more than 400 properties and $1,800 when you onboard more than 900 properties. FreshBooks integrates with lots of apps you already use (and some new ones you’ll be glad you found) to make running your business a breeze.

With FreshBooks, you can automatically send late payment reminders to your tenants, so you don’t have to worry about keeping track of all your rent deadlines. Your tenants receive polite late payment reminders and you don’t have to lift a finger. Make sure your software includes accounting features that facilitate record-keeping.

Yardi Breeze can be used for single-family and multifamily rentals, commercial properties, and mixed-use buildings. Users can set up recurring expenses, access and view transactions directly from bank feeds, and smart scan receipts for upload and storage. Landlord Studio’s advanced financial reporting includes over 15 customizable reports designed specifically for landlords. Keeping rental properties in top shape takes a steady cash flow, so you need tenants to pay their rent on time. FreshBooks makes it easier than ever for tenants to submit rent payments so you don’t have to waste time chasing down checks.

Best for Landlords to Manage Rental Businesses

Overall, Landlord Studio empowers landlords with the tools they need to manage their rental properties effectively while minimizing the complexities of real estate accounting. With its focus on ease of use and robust reporting capabilities, Landlord Studio stands out as a go-to solution for landlords looking to enhance their financial management processes. Overall, Stessa offers an effective blend of property management and accounting tools, making it easier for landlords to manage their portfolios efficiently. Its user-friendly interface and powerful automation features set it apart in financial technology, allowing property owners to focus on growing their investments. Another unique aspect of DoorLoop is its RapidRent feature, which automates rent collection.

Financial Reporting

FreshBooks is an all-in-one accounting solution that manages all your bookkeeping needs, from creating professional invoices to tracking your business expenses and accepting rent payments. Recording a rental in accounting involves several steps to ensure that all financial transactions related to the rental property are accurately captured. You would debit the cash account, which increases your cash balance, and credit the rent revenue account, which recognizes the income generated from the rental. If you use an accrual accounting system, rent should be recorded as income when it is earned, regardless of when it is received. Additionally, any related expenses, such as property management fees, maintenance costs, or mortgage interest, need to be recorded in the respective expense accounts.

Inbuilt Receipt Scanner and Mileage Tracking

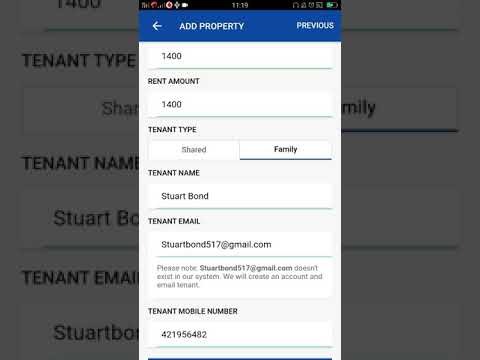

For example, large real estate agencies need different features and capabilities than solopreneur agents. FreshBooks is a popular accounting software for small businesses, freelancers, and businesses with employees or contractors. It offers features such as invoicing, billing and payments, expense tracking, and accounting tools. One of its standout features is the team management functionality, which allows landlords and property managers to add team members, assign specific properties, and set customized permissions. This feature enables teams to collaborate, track activity, and complete tasks seamlessly, ensuring every property is managed effectively.

Sage’s construction management solutions help users win bids, connect teams, and nonbank financial institution deliver projects on time and within budget. By simplifying service operations and optimizing service dispatching, the software ensures that companies can respond quickly to client needs and maintain high standards of service. Whether managing residential properties or large construction projects, Sage 300 provides the tools necessary to achieve business goals effectively. Xero provides an affordable solution for real estate businesses looking to enhance their accounting practices while maintaining the flexibility of cloud-based technology.