Filing Form 990 for Nonprofits

The intermediate sanction regulations are important to the exempt organization community as a whole, and for ensuring compliance in this area. The rules provide a roadmap by which an organization can steer clear of situations that may give rise to inurement. Some members of the public rely on Form 990, or 990-EZ, as the primary or sole source of information about a particular organization. How the public perceives an organization in those cases may be determined by the information presented on its returns. Premiums consist of all amounts received as a result of entering into an insurance contract. They are reported on Form 990, Part VIII, line 2, or on Form 990-EZ, Part I, line 2.

A Guide for Private Foundations: Tax Exemption and 990-PF Filing Requirements

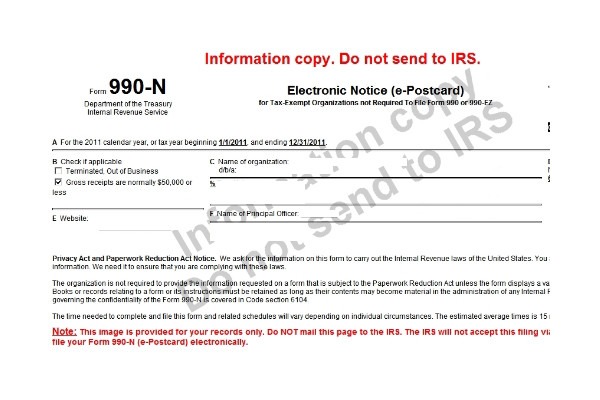

If FMV can’t be readily determined, use an appraised or estimated value. Check the box in the heading of Part I if Schedule O (Form 990) contains any information pertaining to this part. An organization must support any claim to have liquidated, terminated, dissolved, or merged by attaching a certified copy of its articles of dissolution or merger approved by the appropriate state authority. If a certified copy of its articles of dissolution or merger isn’t available, the organization may submit a copy of a resolution(s) of its governing body approving plans of liquidation, termination, dissolution, or merger. If the organization is described in (3), then it must submit Form 990-N unless it voluntarily files Form 990 or 990-EZ.

- Answer “Yes” on line 18 if the sum of the amounts reported on lines 1c and 8a of Form 990, Part VIII, exceeds $15,000.

- If “Yes,” describe on Schedule O (Form 990) the organization’s practices for monitoring proposed or ongoing transactions for conflicts of interest and dealing with potential or actual conflicts, whether discovered before or after the transaction has occurred.

- Sam wouldn’t report the $5,000 in nontaxable family educational benefits in column (e) because it is excluded under the $10,000-per-item exception for column (e).

- An excess benefit transaction can also occur when a disqualified person embezzles from the exempt organization.

- The sale of the stock, and the related sales expenses (including the amounts reported on lines 1f and 1g), must be reported on lines 7a through 7d.

Under section 501(c), 527, or 4947(a)( of the Internal Revenue Code (except private foundations)

A regional or district office isn’t required, however, to make its annual information return available for inspection or to provide copies until 30 days after the date the return is required to be filed (including any extension of time that is granted for filing such return) or is actually filed, whichever is later. An annual information return doesn’t include any return after the expiration of 3 years from the date the return is required to be filed (including any extension of time that has been granted for filing such return) or is actually filed, whichever is later. Compensation includes https://etnoportal.ru/msk/afisha/8019 fees and similar payments to independent contractors but not reimbursement of expenses. However, for this purpose, the organization must report the gross payment to the independent contractor that includes expenses and fees if the expenses aren’t separately reported to the organization. All tax-exempt organizations must pay estimated taxes on their unrelated business income if they expect their tax liability to be $500 or more. Check “Yes” on line 35a if the organization’s total gross income from all of its unrelated trades and businesses is $1,000 or more during the tax year.

2020 Form 990 and instructions contain notable changes

The person who has ultimate responsibility for managing the organization’s finances, for example, the treasurer or chief financial officer. The value that would ordinarily be paid for like services by like enterprises under like http://atrex.ru/press/p323437.html circumstances. Any contribution of a qualified real property interest to a qualified organization exclusively for conservation purposes. A “qualified real property interest” means any of the following interests in real property.

What happens if nonprofits don’t file 990s?

If a section 501(c) organization establishes and maintains a section 527(f)(3) separate segregated fund, it is the fund’s responsibility to file its own Form 1120-POL if the fund meets the Form 1120-POL filing requirements. Do not include the segregated fund’s receipts, expenditures, and balance sheet items on the Form 990-EZ of the section 501(c) organization that establishes and maintains the fund. When answering question 37 on its Form 990-EZ, the section 501(c) organization should disregard the political expenses and Form 1120-POL filing requirement of the segregated fund. However, when a section 501(c) organization transfers its own funds to a separate segregated section 527(f)(3) fund for use as political expenses, the section 501(c) organization must report the transferred funds as its own political expenses on its Form 990-EZ. Only the following tax-exempt organizations are subject to the section 6033(e) notice and reporting requirements, and a potential proxy tax.

Loans and other receivables from current and former officers, directors, trustees, key employees, and creator or founder, substantial contributor, or 35% controlled entity or family member of any of these persons. Don’t net any rental income received from leasing or subletting rented space against the amount reported on line 16 for occupancy expenses. If the tenant’s activities are related to the organization’s exempt purpose, report rental income as program service revenue on Part VIII, line 2, and allocable occupancy expenses on line 16. However, if the tenant’s activities aren’t program related, report the rental income on Part VIII, line 6a, and related rental expenses on Part VIII, line 6b.

Data Processing, Web Search Portals, and Other Information Services

The IRS requires an extensive amount of information from the organization; the instructions for how to complete the 12-page form are 100 pages in length. Additionally, the organization can be http://www.greensboring.com/2017/01/food-lion-saying-one-thing-and-doing.html subject to a large penalty if it does not file on time. Instead of scrambling to pull together financial information on an annual basis, take regular maintenance steps throughout the year.

- If certain excise, income, social security, and Medicare taxes that must be collected or withheld aren’t collected or withheld, or these taxes aren’t paid to the IRS, a trust fund recovery penalty may apply.

- If the organization can’t distinguish between reportable compensation and other compensation from the unrelated organization, report all such compensation in column (D).

- For purposes of Form 990, a current key employee is an employee of the organization (other than an officer, director, or trustee) who meets all three of the following tests, applied in the following order.

- Management companies and similar entities that are independent contractors shouldn’t be reported as key employees.

- Thus, Sam’s total compensation of $97,000 wouldn’t place Sam among the five highest compensated employees over $100,000.

However, report expenses related to the production of program-related income in column (B) and expenses related to the production of rental income on Part VIII, line 6b. Rental expenses incurred for the organization’s office space or facilities are reported on line 16. In both Example 1 and Example 2, the organization would need to report the $5,000 value of this contribution on Schedule M (Form 990) if it received over $25,000 in total noncash contributions during the tax year. Compute the organization’s gross income from fees, ticket sales, or other revenue from fundraising events.